Invisible Digital Receipts

By Mark Johnson – CEO

Receipt Reliance Pty Ltd

The payments space is seeing an extraordinary amount of

innovation taking place. Now there are many ways for consumers to pay for goods

and services and it's still evolving. One thing many payment providers are

striving for is the best customer experience possible; the least amount of

friction the better. In fact the word 'invisible' is now being used to describe

the ideal payment experience, the objective being that no sooner you've

indicated that you wish to purchase something than it just happens in the

background. Wouldn't it be great if the final part of the transaction, the receipt,

was invisible too?

Arguably, the most common way to receive a digital receipt

is via email. Apple pioneered this method back in 2005 and is still doing it. With this idea in

mind, receipt companies have emerged with add-on solutions whereby after some software

integration at the POS, consumers are required to give out an email address in

order to receive an 'e-receipt'. POS vendors themselves are now following this

lead and building customer email address capture and email receipt issuance into

their software, often delivered as part of a maintenance upgrade.

While email

receipts have started to gain traction, they haven't taken off as might have

been expected and are just one of several methods trying to gain market share. Consumers are wary about giving out personal

information knowing they run the risk of their inbox being inundated with

unwanted marketing material, as well as concerns about fraud and phishing scams, and at the end of

the day they are still responsible for the storage and management of their

receipts.

Another type of digital receipt solution that has begun to

gather pace is cloud based receipt storage accessible via an app on your PC or

mobile device. What is transformational about

these new cloud based solutions is that many are now embracing POS/data

integration where the app talks with the merchant's POS system to collect the

receipt.

While this is an important step forward, it raises another

issue that may not have been fully appreciated; If a lot of cloud based solutions

with POS/data integration start to appear, won’t they still present the

customer with the dilemma of multiple logins etc and perhaps some consolidation

tasks for filing receipts from different cloud based apps into one place? Not

to mention the loss of valuable screen real estate on your mobile device,

tablet and/or PC as you would have to download multiple merchants' apps just to

get a digital receipt!

The objective is to simplify our lives and it's just not

practical to expect consumers to download a new app each time they visit a different

merchant. It could be argued that perhaps digital receipts should not be app

related at all; that what is required is a common method, rather than a common

app.

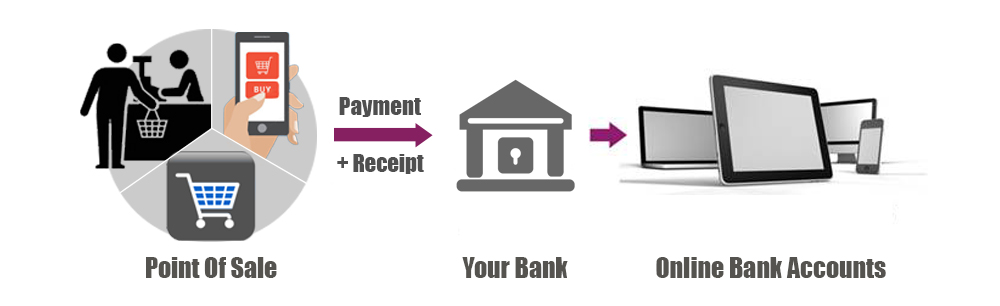

If we have POS/data integration with merchant receipt linked

to the bank payment transaction via banks' own payments pipes or via a bank accessible

cloud storage location, the customer will win. They will win because whether

its cloud or bank pipes, the customer need not worry that they don’t have a

particular merchant's app; they will just go to their familiar banking portal (app

or internet login) and the receipt will be there, no friction and no lost

receipts.

Think of it this way:

·

Digital receipt app per merchant = many merchant receipt apps per customer device

·

Digital receipt via your bank portal = no

merchant receipt apps on customer device

There are some companies moving in this direction but they

only have part of the equation. While they have the POS/data

integration triggered by a bank card payment, they are lacking the link to the

bank payment transaction and thus not taking advantage of all the value that

doing so offers. They also require the disclosure of your payment card details

which creates another point of vulnerability should the Digital Receipt company

suffer a data breach. Others have provided for digital copies of paper receipts

and email receipts to be matched and/or manually linked to a bank payment transaction

but again the opportunity is there for error, fraud and friction because it

relies too heavily on customer input to make it work. Having a digital receipt

captured and then stored by your bank at the time you make an EFT payment

avoids all the above concerns.

The adoption of a digital receipt solution like this may

take time however I feel that any reservations some merchants might have will

be resolved by natural competitive market forces; merchants, and banks, will

not want to miss the opportunity to attract new customers and strengthen their

existing customer base. When EFTPOS was first introduced in the US in 1981,

merchants and consumers were initially slow to accept it, however that soon

changed and today it is widely used around the globe. I think the same will

happen for a digital receipt solution such as this. When consumers and

businesses experience the convenience and added value it will afford, the only thing they will be asking is 'why has

it taken so long?'.